broward county business tax receipt form

Apply for your Business Tax account. County ordinance 88-35 classification codes for business tax fee schedule occupation requirements 21-3013500 31 or more15000 wrought iron 271.

Application For Local Business Tax Receipt Templates At Allbusinesstemplates Com

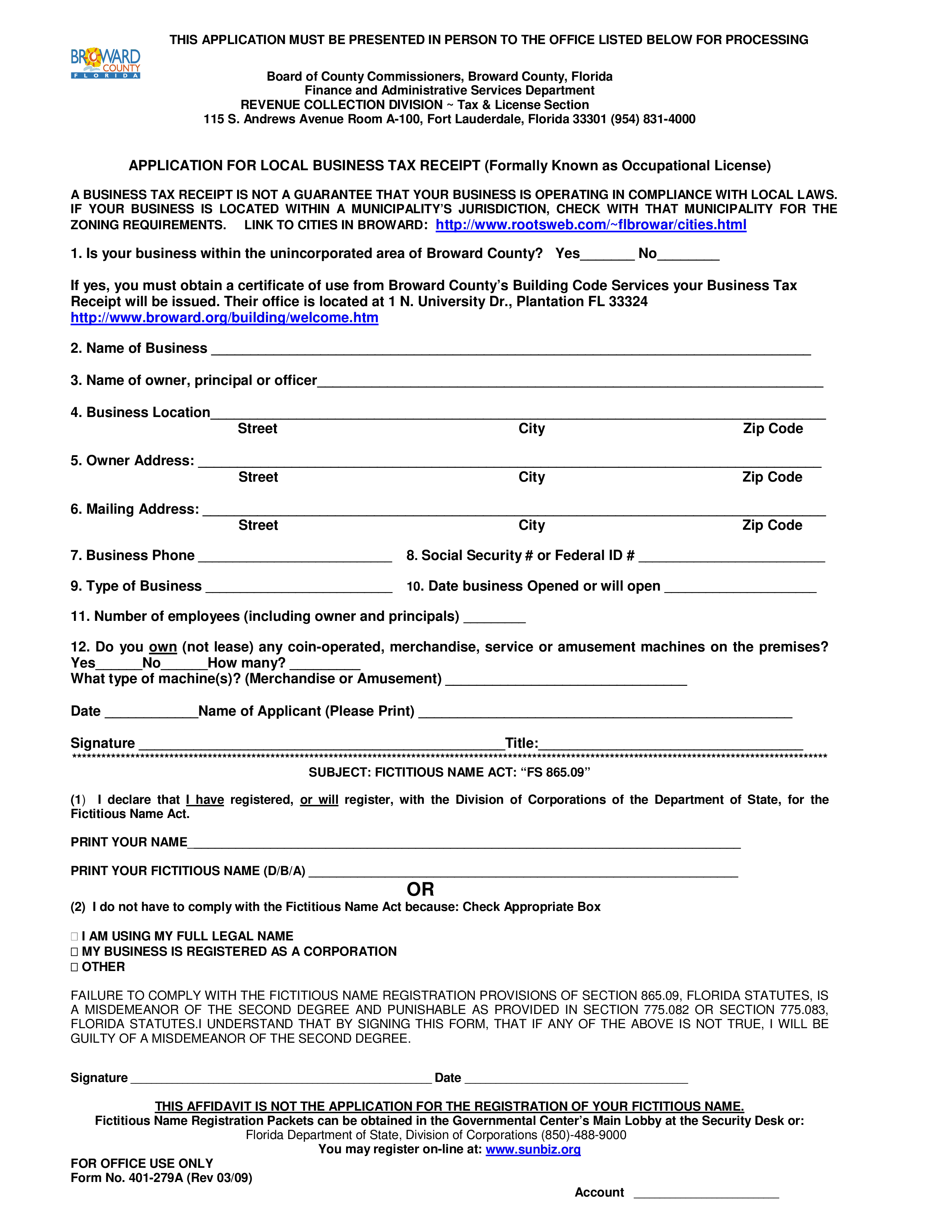

The Local Business Tax formerly known as Occupational License is required of any individual or entity any business or profession in Broward County unless specifically exempted.

. Enter a name or address or account number etc. Click here for more information. Lauderdale fl 33301-1895 954-831-4000 valid october 1 through september 30.

You will also be required to include a copy of your Florida drivers license or state-issued identification and to complete the Home Office Affidavit to submit with your application. As the Countys tax collector provides treasury services and is the statutory repository for the Official Records of the County. The vendor must have a Broward Business Tax Receipt and be located in and doing business in Broward County.

Andrews Avenue Room A-100 Fort Lauderdale Florida 33301 954-831-4000 FAX 954-357-5479. A registration form must be completed and submitted to the Tourist Development Tax Section. Broward County business tax receipt registration.

Any profit corporation limited liability company limited partnership or limited liability limited partnership annual report filing will have until 1201 am on July 1 2020 before a 400 late fee is assessed. The Local Business Tax formerly known as Occupational License is required of any individual or entity choosing to engage in or manage any business profession or occupation in Broward County unless specifically exempted. Broward County businesses will now be able to file an application for a new Business Tax Receipt andor change address information on an existing Business Tax Receipt here.

954 831-4000 Florida Board of County Commissioners Broward County Florida Finance and Administrative Services Department REVENUE COLLECTION DIVISION Tax License Section 115 S. Broward County Business Tax Receipts. 2021 Property Tax Bill Brochure PDF 220 KB 2021 Taxing Authorities Phone List PDF 72 KB Frequently Asked Questions about Your Tax Bill PDF 240 KB Affidavit for.

Tax License Section. The City issues restricted business tax receipts to work out of the home. A Local Business Tax Receipt is required for each location you operate your business from and one for each category of business you conduct.

Room A 100 Fort Lauderdale FL 33301. How To Pay Tourist Development Tax. After registering a filing frequency of monthly.

Broward county local business tax receipt 115 s. Registration Form and Instructions. The Local Business Tax formerly known as Occupational License is required of any individual or entity any business or profession in Broward County unless specifically exempted.

Use the buttons below to apply for a new Business Tax account and obtain your Broward County Business Tax receipt or request a change to your existing Business Tax account. Taxpayers registering for Tourist Development Tax may be required to obtain a Broward County Local Business Tax Receipt. A Business Tax Receipt will be issued if the business meets the City requirements.

A business representative may submit your application in person on your behalf. When you pay a Local Business Tax you receive a. Welcome to Broward County BTExpress.

Andrews Avenue Room A-100 Fort Lauderdale Florida 33301 954 831-4000 APPLICATION FOR LOCAL BUSINESS TAX RECEIPT Formally Known as Occupational License. BROWARD COUNTY FL - The Countys Records Taxes and Treasury Division RTT is enhancing services offered to County businesses beginning today Wednesday July 1st. The Division part of the Finance and Administrative Services Department collects residential and commercial property taxes local business taxes tourist development taxes and other taxes on behalf of various authorities.

Each owner must not have a personal net worth exceeding 1320000. Apply for a new account. Broward County - Fictitious Name Form PDF 223 KB List of Local Business Tax Receipt Categories PDF 72 KB Local Business Tax Receipt Exemption Application Form PDF 149 KB Property Taxes.

New businesses may also present applications for a Broward County Local Business Tax Receipt in person at Broward County Records Taxes and Treasury Division Governmental Center Room 115 S. When you pay a Local Business Tax you receive a Local Business Tax Receipt which is valid for one. Applicant resides in Broward County Florida the permanent address of applicant is.

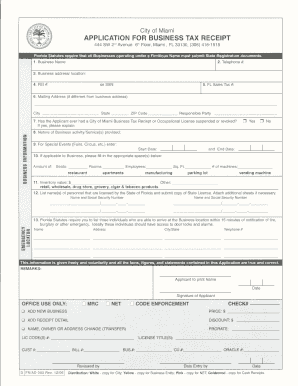

APPLICATION FOR BUSINESS TAX. A Local Business Tax Receipt is required for each location you operate your business from and one for each category of business you conduct. Lauderdale business tax receipt registration.

Fill Free Fillable Broward County Florida Pdf Forms

Free 5 Sample Business Tax Receipts In Ms Word Pdf

List Of Local Business Tax Receipt Categories Broward County

Lauderhill Area Broward County Local Business Tax Receipt 305 300 0364

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

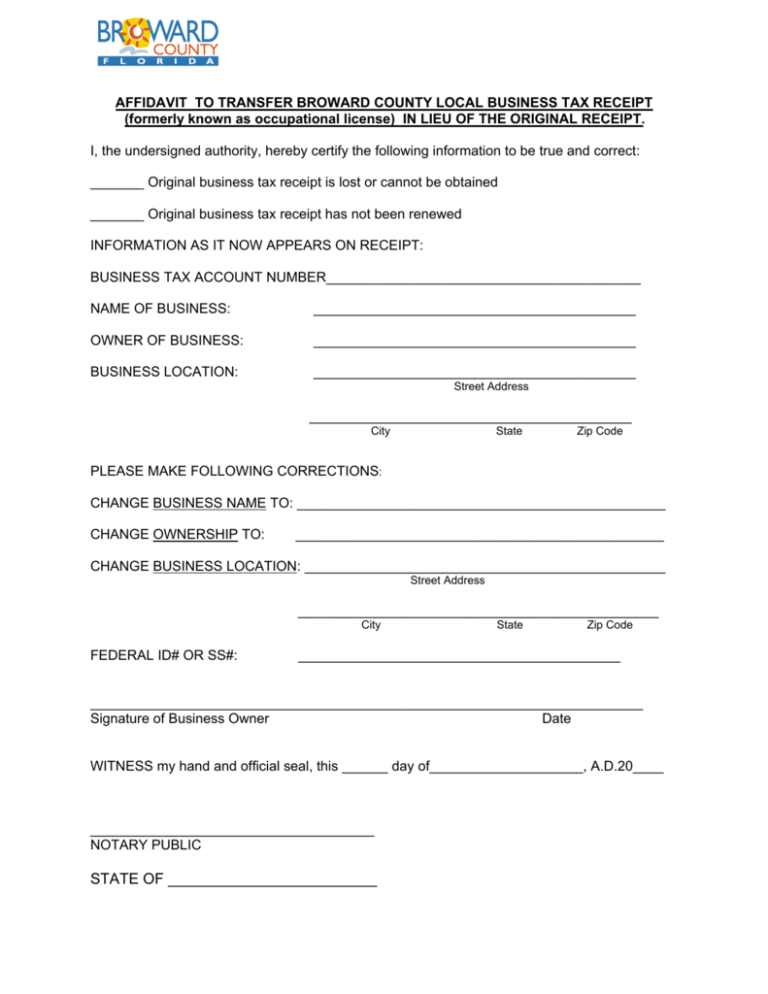

Affidavit To Transfer Broward County Local Business Tax Receipt

Affidavit To Transfer Broward County Local Business Tax Receipt

Permit Source Information Blog

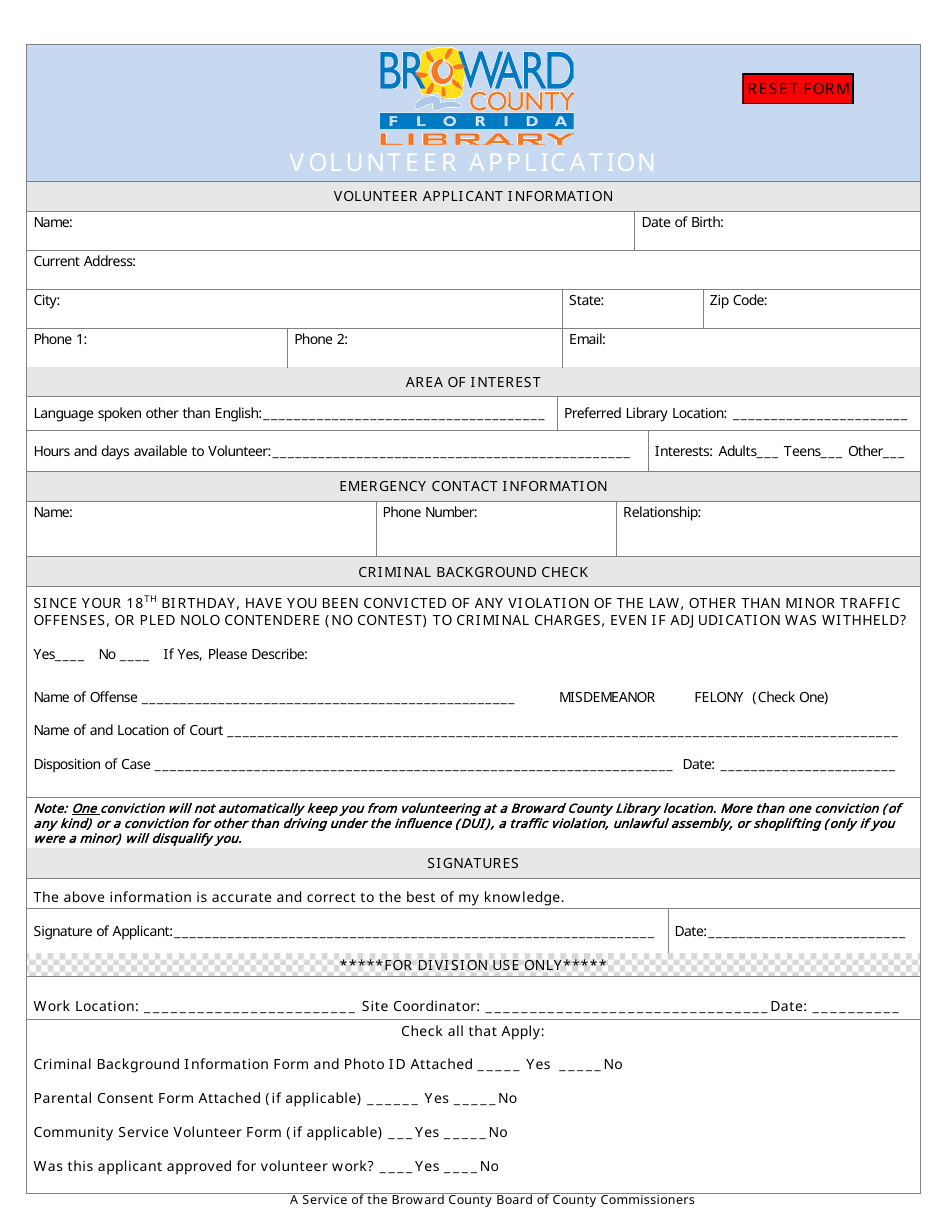

Broward County Florida Volunteer Application Form Broward County Library Download Fillable Pdf Templateroller

Fill Free Fillable Broward County Florida Pdf Forms

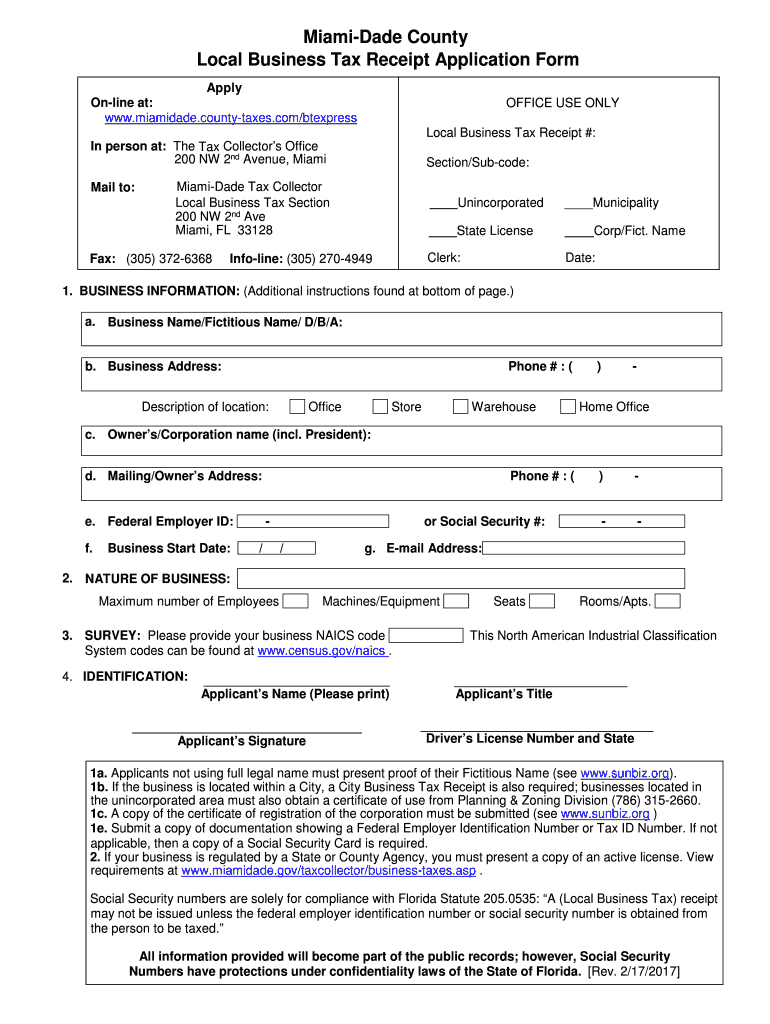

Fl Local Business Tax Receipt Application Form Miami Dade County 2017 2022 Fill Out Tax Template Online Us Legal Forms

Affidavit To Transfer Broward County Local Business Tax Receipt

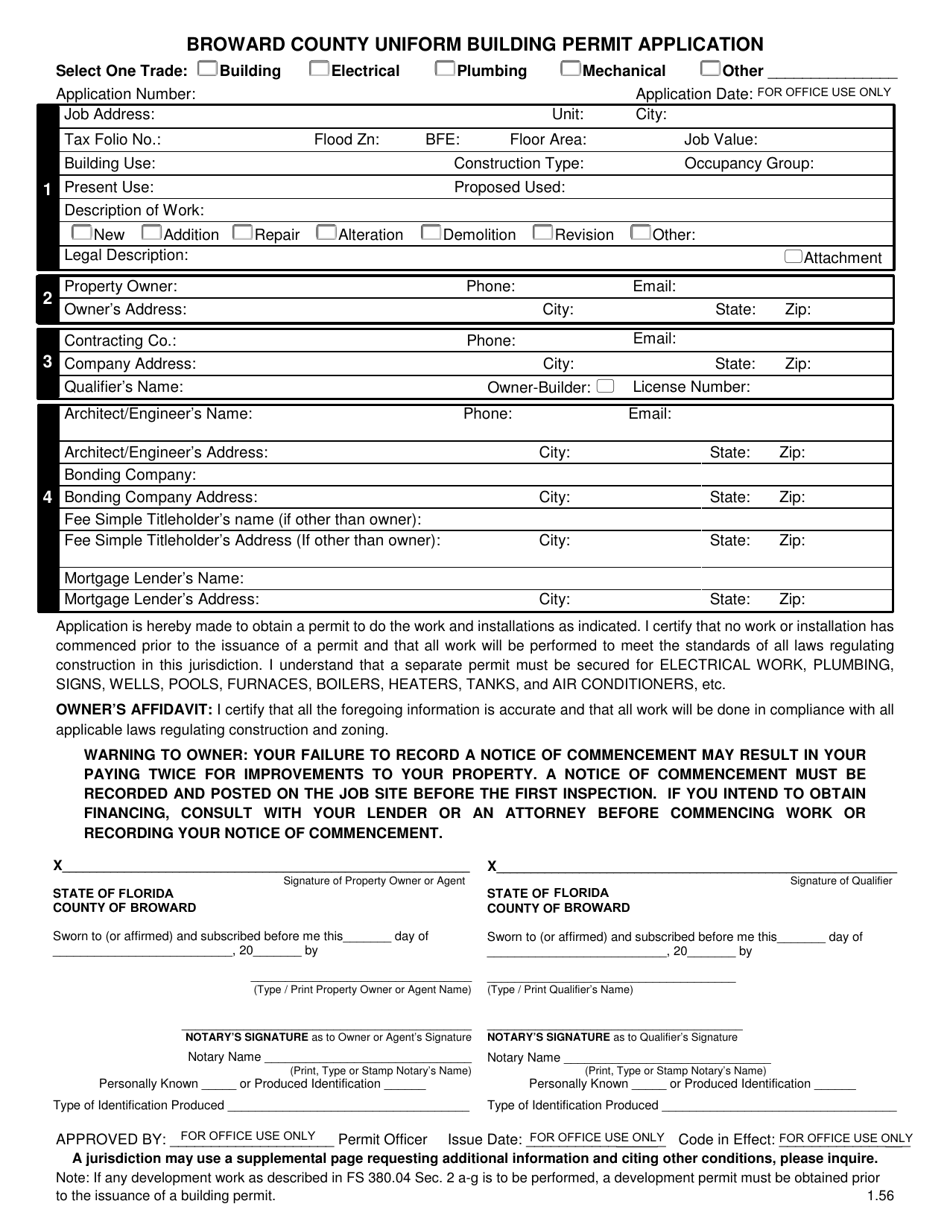

Form Ab 279 Download Fillable Pdf Or Fill Online Uniform Building Permit Application Broward County Florida Templateroller